2 hours ago

Latest

Update

Latest Updates

Featured Posts

Get in Touch

Location:

123 Innovation Street

Tech District, CA 94105

123 Innovation Street

Tech District, CA 94105

Email:

[email protected]

[email protected]

Phone:

+1 (234) 567-890

+1 (234) 567-890

News

Unveiling the Revamped Adventure of DQ7

Brian Hernandez

Sep 18, 2025

Brian Hernandez

Sep 18, 2025

News

Why Hollow Knight: Silksong Is So Dang Hard, As Explained by the Game's Creators

Brian Hernandez

Sep 18, 2025

News

Blaze Haze Could Cause Nearly 1.4 Million Lives Annually by 2100 if Greenhouse Gases Persist, Analysis Projects

Brian Hernandez

Sep 18, 2025

News

Powerhouses the Black Ferns Brace For Nemesis Canada in Rugby World Cup Semi-Final

Brian Hernandez

Sep 18

News

El Cholo, Anfield and Some Shouting in the Stadium

Brian Hernandez

Sep 18

Today's Top Highlights

Discover our latest stories and insights from around the world

News

News

News

News

McLaughlin-Levrone clocks quickest female 400m in four decades to secure gold

By Brian Hernandez

•

18 Sep 2025

By Brian Hernandez

•

18 Sep 2025

News

News

British Public Media Networks Call for Greater Visibility on Video Platforms to Fight Misinformation

By Brian Hernandez

•

18 Sep 2025

By Brian Hernandez

•

18 Sep 2025

News

News

Ludwig van Beethoven's Sonatas for Violin: Opp 12 no 2 & 96 – A Celebration of Sheer Artistic Delight

By Brian Hernandez

•

18 Sep 2025

By Brian Hernandez

•

18 Sep 2025

News

News

Jose Mourinho Announced as Head of Sport Lisboa e Benfica

By Brian Hernandez

•

18 Sep 2025

By Brian Hernandez

•

18 Sep 2025

News

News

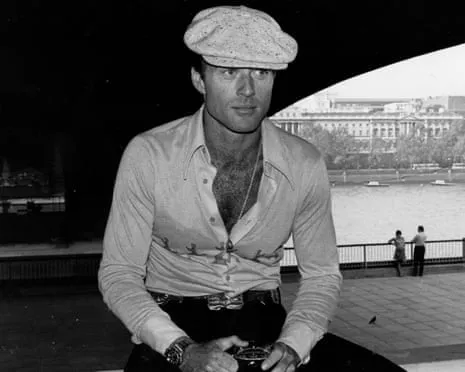

How Robert Redford Reshaped Men's Fashion On and Off the Screen

By Brian Hernandez

•

18 Sep 2025

By Brian Hernandez

•

18 Sep 2025

News

News

Trump Abandoned His Pledge of Presidency. History Shall Not Regard Him Favorably

By Brian Hernandez

•

18 Sep 2025

By Brian Hernandez

•

18 Sep 2025

News

News

British-American Tech Agreement Raises Key Concerns Despite £31bn Funding Pledge

By Brian Hernandez

•

18 Sep 2025

By Brian Hernandez

•

18 Sep 2025

News

News

José Mourinho Confirmed as Benfica's Head Coach Through 2027

By Brian Hernandez

•

18 Sep 2025

By Brian Hernandez

•

18 Sep 2025

News

News

Among the Top-Tier Arcs in One Piece Is Finally Arriving to Netflix

By Brian Hernandez

•

18 Sep 2025

By Brian Hernandez

•

18 Sep 2025

News

News

A Younger Lover from Annie Ernaux: A Study of a Romance Spanning Years

By Brian Hernandez

•

18 Sep 2025

By Brian Hernandez

•

18 Sep 2025

News

News

Rediscover the Ultimate Childhood Game Sensation with Bop It: A New Gaming Experience

By Brian Hernandez

•

18 Sep 2025

By Brian Hernandez

•

18 Sep 2025

September 2025 Blog Roll

August 2025 Blog Roll

July 2025 Blog Roll

June 2025 Blog Roll

Popular Posts

Sponsored News

A Pair of Victims Shot in Incident Adjacent to West Bank-Jordan Checkpoint, Israeli Military States

Brian Hernandez

Brian Hernandez

18 Sep 2025

The Witcher's Gory New Adventure Disclosed in The Witcher's Blood Stone Saga Exclusive Preview

Brian Hernandez

Brian Hernandez

18 Sep 2025

Alex Lawther Admitted Astonishment to Learn His Andor Manifesto Spread Rapidly

Brian Hernandez

Brian Hernandez

18 Sep 2025